Overview Summary

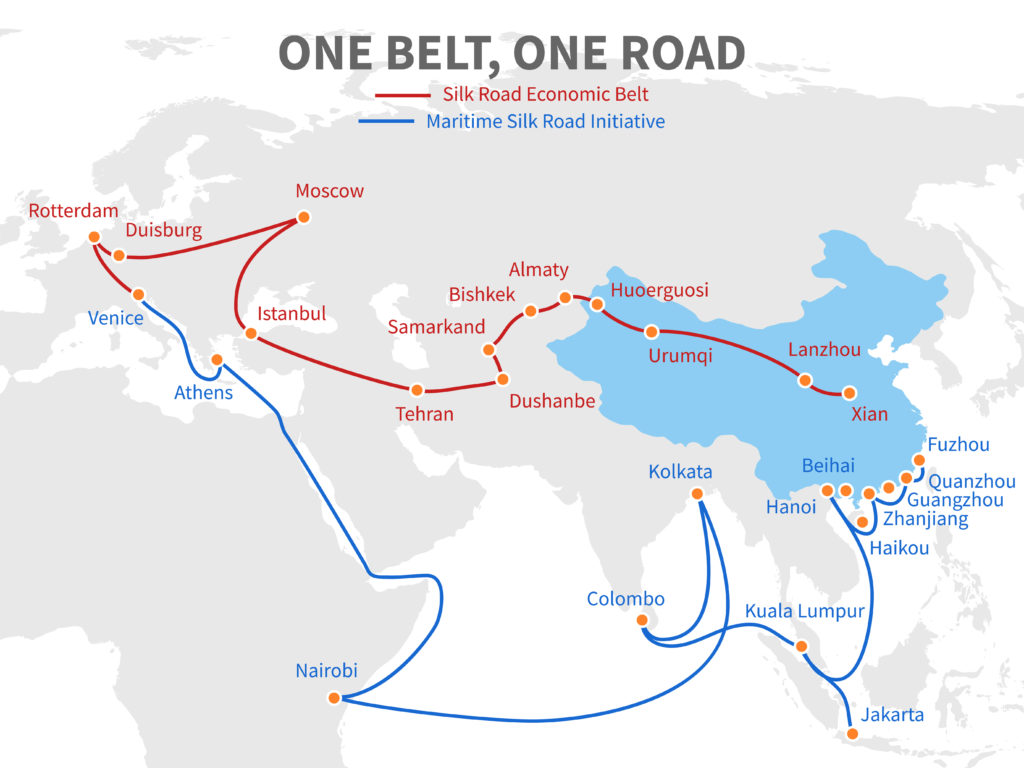

On June 29th 2018, the Center for International Private Enterprise (CIPE) hosted an panel discussion on China’s Belt & Road Initiative (BRI) and how firms can work to mitigate the impacts. Since opened on May 14, 2017, BRI has initiated massive development projects that aim to improve infrastructure in developing countries throughout Central Asia, Eastern Europe, and South Asia. Due to high demand and a lack of quality infrastructure in those countries, BRI investment was highly sought after As increasing capital flows from both public and private sectors, today’s panel focused on what the opportunities and risks are for investors in terms of global governance and the regional impacts of BRI. The moderator for the panel was Abdulwanhab Alkebsi, the managing director for programs at CIPE, and the panel invited 3 experts from CSIS, Brookings, and CIPE to discuss on issues related to investment in BRI and global governance.

Political Risks of Investment for BRI

As emphasized by panelists, good governance is an important indicator for whether or not a project will provide a return on investment. At the time of the event, the panelists felt the BRI currently has a balanced portfolio of countries with good and poor governance. Money flowing into countries with good governance such as Singapore and Malaysia are expected to generate economic growth, create more jobs, and benefit the recipient countries; however, capital flowing into poor governance countries (such many in African) is less likely to have positive economic outcomes due to corruption and a lack of transparency, which may lead to serious debt issues in the future.

BRI projects themselves often suffer from a lack of transparency and their progress is hard to track. The spending associated with a BRI project is often not included in recipient countries’ national budget. Additionally, all the information regarding this initiative tends to be closely held within the confines of the Chinese government. Thus, there is little public oversight over the money flowing in and out of recipient countries. The real spending on BRI projects is often exaggerated. According to the panel, the actual estimated spending is around $50 billion USD per year on projects.

Environmental Risks

One of the panelist discussed the potential environment issues surrounding BRI projects. Although China’s claim that they are following all local laws seems reasonable, many developing countries involved in BRI do not have well developed environmental protection laws. China only implements standards for environment impact on voluntary basis. More often then not, the lack of environmental implementation is likely to negatively affect the local population in the long run

Role of private sectors in BRI

According to the panel, 90% of BRI contracts go to Chinese firms, most of which are state-owned enterprises (SOEs) or a subsidiary. Only a small portion of contracts go to businesses in recipient countries. BRI projects generally lack local business participation and local capacity building. Moreover, the reputation of Chinese companies and government is negative in countries the BRI is directly involved in, so their presence will sometimes generate resentment in media coverage and among locals which affects the government’s willingness to do business.

Driven factors behind BRI

A common question about investment is; Why does China want to invest in developing countries that carry such high risks other investors are kept at bay?

According to the panel, China faces overcapacity issues. There too many factories and infrastructure companies in China and little room for them to grow. Furthermore, China is looking for any opportunity to climb out from the bottom of the manufacturing food chain by applying additional value layers onto the process. The ultimate goal is to upgrade China’s place the supply chain and move all of their factories to lesser developed countries. Building infrastructure under the auspices of the BRI also reaps long term benefits for private business since building rail and trains are not one-off money-making enterprises. Countries will come back to Chinese companies for maintenance and upgrades, helping Chinese firms to maintain a steady flow of business. However, one public and negative aspect of these deals often takes the form of defaults on debts allowing Chinese firms/government to potentially take control of key areas of infrastructure.

Additionally, BRI projects cannot be separated from geopolitical and economic influences. Many BRI projects partner with countries that are rich with natural resources, giving China access to important ports and resources in the region. Leadership in Beijing is assessed to reset regional and global norms by placing China at the global center of the BRI economy.

FAO Global Assessment

China’s Belt and Road Initiative has been welcomed in many developing countries where it creates opportunities for firms to invest, fueled by infrastructure gaps and China’s overcapacity of construction firms. However, risks of corrupt governance and transparency, and political backlash are threatening the success of BRI projects. Companies need to conduct research on recipient countries’ capability to repay the project and the perceived levels of corruption in the local government. Meanwhile, balancing a good relationship with the Chinese government and the recipient countries is also key. All parties involved will benefit from more reliable data and a level playing field. Companies can also put pressure on Beijing through media and civil society to provide more access to projects’ spending information and progress.

About the Author: Weiting Li is an international policy intern at FAO Global, where she focuses on international trade, technology, and environmental policies. Weiting is currently a second year graduate student pursuing dual master’s degrees in public policy at Georgetown University and Business Administration at University of Geneva. Prior to Georgetown, she was the assistant for government relations and working groups at European Chamber of Commerce in China. She graduated from Gettysburg College with a major in Sociology and a minor in Business.